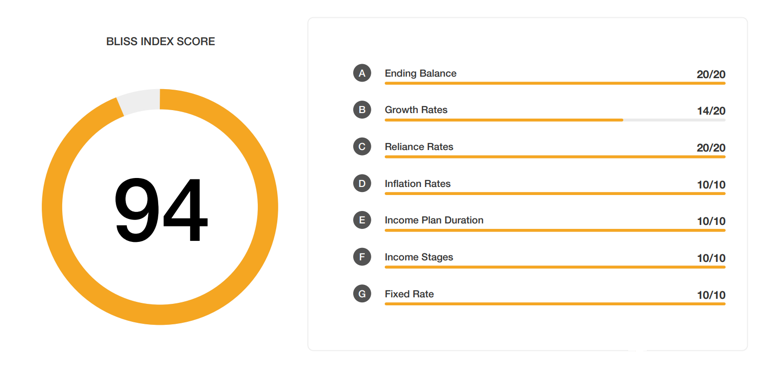

The next big thing in retirement income planning is here. You can make any retirement plan look good on paper, but what is the probability that the plan will prove to be successful for your client? The Bucket Bliss Index is a new tool embedded in Bucket Bliss Advisor that measures a combination of seven components on a scale of 1-100 to allow both you and your clients to see how viable their retirement plan is; the higher the Bliss Index, the more likely the plan is to succeed. Once the Bliss Index has been calculated, you can view how each component scored, and edit the plan to build a more efficient one for your clients. Knowing what you can do to create a better retirement plan for your clients will help you act in their best interest and ensure your practice’s DOL compliance.

The seven components of the Bliss Index are:

Ending Balance

The ending balance of each income plan is scored based on its percentage of the beginning balance. The objective is to end with approximately the amount you started with. This is one component of the index that is capped when growth rates of each bucket increase as a result of unrealistic growth rates affecting the index score for this component.

Growth Rates

The growth rate associated with each bucket accounts for a portion of the index score for this component. The lower the growth rate, the higher the score for this component. While growth rates of buckets 1 and 2 should be more conservative, growth rates of buckets 3 and 4 can be more aggressive.

Reliance Rate

The reliance rate is defined as the bucket income as a percentage of the total income. To score high on this component of the index the income coming from the buckets must be approximately 50% or less of the total income. Using annuities and other income producing products can increase the other income of a particular plan, thereby reducing the reliance on the buckets to meet the clients desired income.

Inflation Rate

A low inflation rate associated with an income plan essentially equates to more spending power early in the plan and less later. To score high on this component of the index, the inflation rate of the desired income needs to closely approximate the long-term CPI.

Income Plan Duration

The income plan duration score is a function of the clients age. Income plans that illustrate income into client age 90’s score high while income plans ending in their 70’s score low. As with all components of the Bucket Bliss Index, if other considerations or health conditions of a given client make it unlikely that they’ll live into their 90’s, a lower score for this component is acceptable.

Income Stages

Much like having a low inflation rate on an income plan can affect the perceived strength of that plan, including too many income stages – particularly turning income down in future years – also can influence the client’s perception of retirement. Having no income stages will score highest, while having as few as two income stages will eliminate all points associated with this component of the index.

Fixed Rate

The fixed rate of return that is earned on money that is being spent from each bucket can have a significant effect on the amount of money that is needed to provide income in a given distribution period. While this part of the index can change as short-term interest rates change, currently using money market rates of interest for the fixed rate will score higher on this component of the index.