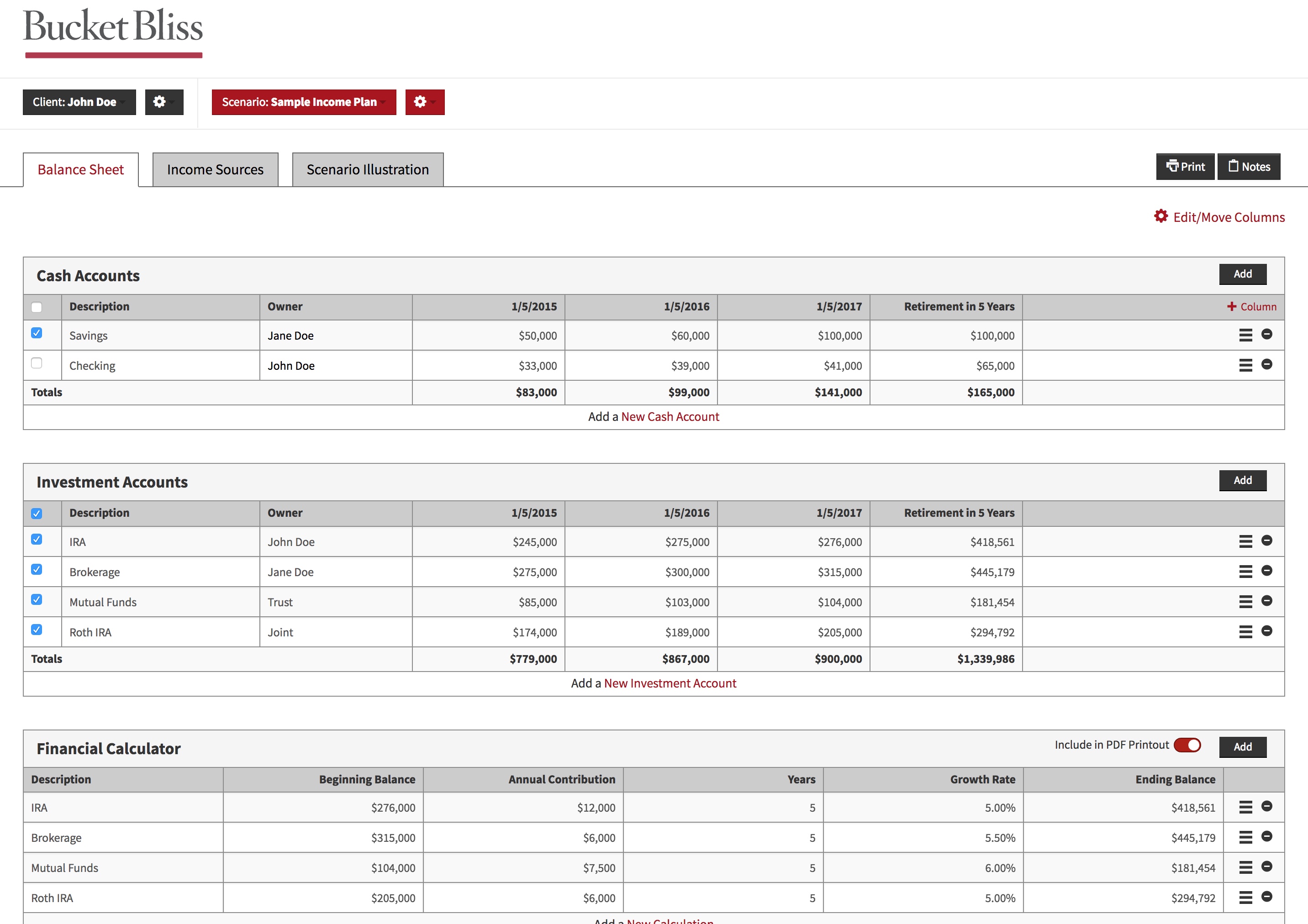

The Balance Sheet

The balance sheet gives you an opportunity to summarize your client's complete financial picture. You can track cash accounts, investment accounts, and even calculate what the future value of an account will be at retirement—with and without additional contributions. You can track balances for several account reviews to give your client a clear understanding of their income plan.